I've occasionally written about this problem, most recently here and here. Now, via Calculated Risk, comes this scary article from The Baltimore Sun [my emphasis added].

[...]I bring this to your attention with the key phrases emphasized that way, because it's not clear to me that everybody understands compound interest calculations well enough to understand how they will be so well and truly fncked when their mortgage resets.

To head off potential problems, the largest mortgage originator in the United States, Countrywide Home Loans, quietly has begun sending out letters to thousands of borrowers who have been making only the minimum payments on the company's popular "PayOption" adjustable-rate mortgages.

The letters explain that "this is an early message to alert you that, based on your current payment trends and potential future interest rate changes, the monthly payment you will be required to pay may increase significantly."

A model letter provided to me by Countrywide includes this hypothetical example of what could be ahead for a California homeowner currently making only minimum payments monthly on a $402,000 loan.

The current full interest rate on the loan is 7.6 percent, but the borrower has been paying just $1,348.47, far less than what's needed to fully amortize the mortgage over its 30-year term.

If the loan reset at today's rates, the letter explains, the full payment required would be $2,887.50 - more than double what the homeowner has gotten used to paying. Future reset rates could be even steeper, making the potential payment crunch much worse.[...]

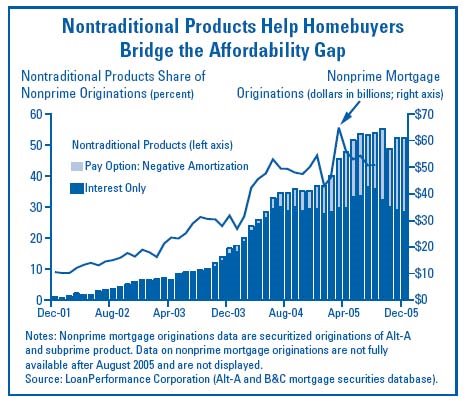

Now that you've internalized that side of the problem, look at this graph again:

All those wonky PayOption and interest-only ding-a-ling mortgages taken out over the last two years to "bridge the affordability gap" are going to start resetting in a huge wave, the leading edge of which is just starting to swell up now, and it will really be rolling quite seriously over America in about six months. Americans don't have the savings to indicate that they've been using these exotic instruments responsibly. There is a financial hurricane coming.

I have a 30-year fixed rate mortgage on a detached house in San Francisco at 5.67% and no 2nd mortgage. On paper, the balance of my loan is a little less than half the comparable price in my immediate neighborhood. I think I'm in a pretty good position to ride out this wave, but I'm still nervous. There are a lot of people who are going to have their lunch money stolen in this market correction. I expect the financial suffering to be horrendous, and in that kind of upheaval, even the people who managed their risks responsibly tend to get the shaft. If you don't believe that, I'd like to send you on a tour of gulf-coast Louisiana and Mississippi.

No comments:

Post a Comment