Over at Calculated Risk, you should check out their excerpt from the Summer 2006 FDIC Outlook. Fascinating.

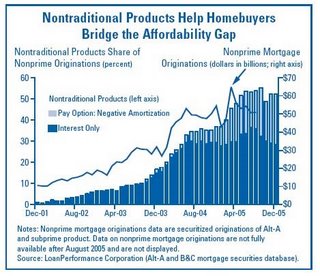

The basic story is that non-traditional sub-prime home mortgages have grown explosively in the last couple of years, primarily as a means of allowing new homebuyers to bridge the so-called "affordability gap" rather than how those mortgages have historically been used, i.e. by real estate speculators.

I'll say it again. There is a financial crisis in the mortgage lending industry winding up for a sucker punch to the global economy. Have you noticed that experienced real estate people have stopped their happy talk about "soft landing" scenarios?

The big question on my mind is whether the unwinding of the mortgage lending imbalance won't trigger an even bigger avalanche in the $300 trillion over-the-counter derivatives market. That would be a financial crisis of unimaginable proportions.

No comments:

Post a Comment